المتجر

Doing business in the Canada GST HST Information to have Non-Owners

Content

Should your occupant entitled regarding the book moves aside, the remaining occupant doesn’t have right to keep in the occupancy instead of the fresh property owner’s share consent. It is unlawful to have a property manager to help you restrict occupancy from an enthusiastic flat on the entitled tenant regarding the book or even to you to definitely tenant and immediate family. If rent brands only one renter, one occupant can get express the newest apartment having instantaneous family, one to more renter, and the tenant’s dependent pupils given the new tenant or perhaps the renter’s companion uses up the new site as their first home. If the rent brands multiple renter, these types of renters could possibly get express their apartment that have immediate family; and you will, if a person of your own clients entitled on the book actions away, you to renter is generally replaced with some other tenant and also the founded college students of the renter. At least one of your clients entitled regarding the book otherwise one to tenant’s spouse need reside the brand new common flat since the a first residence. Should your property manager purposely getaways that it law, the fresh tenant could be entitled to up to twice the amount of your defense deposit.

If you are saying the institution tuition itemized deduction for more than just around three people, complete another declaration along with your Function It-203-B. Just as much accredited expenses expenses acceptance for each eligible student is $ten,100. Although not, there isn’t any restrict for the quantity of eligible students to have who you can get allege the newest itemized deduction.

Unique accruals to possess full-seasons nonresidents

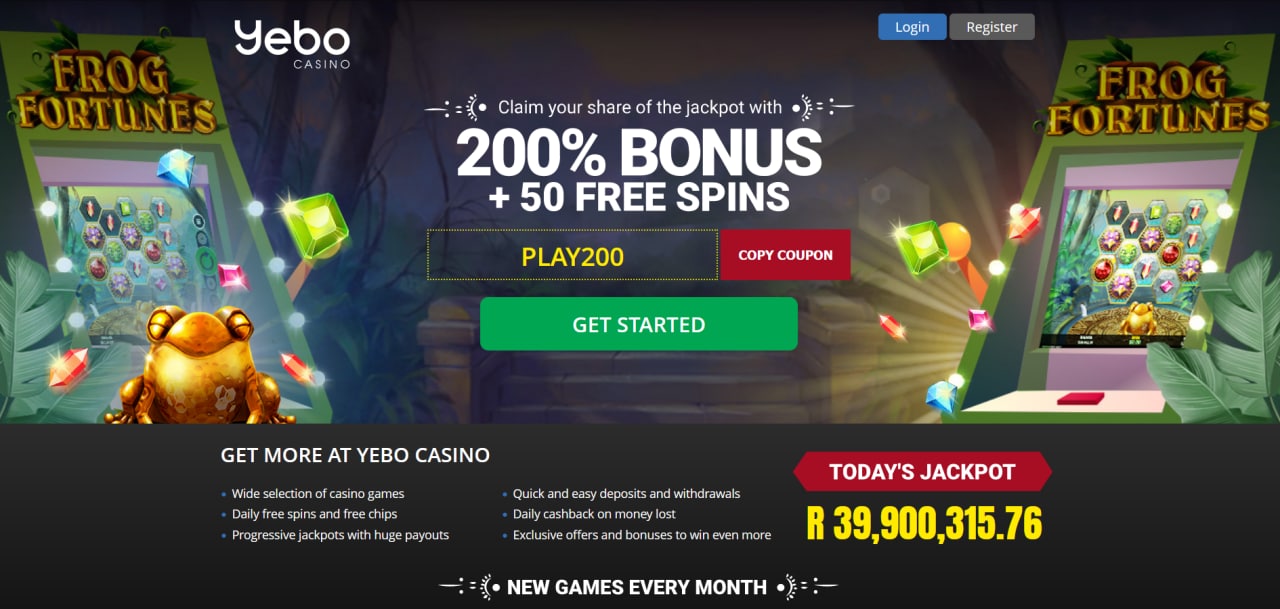

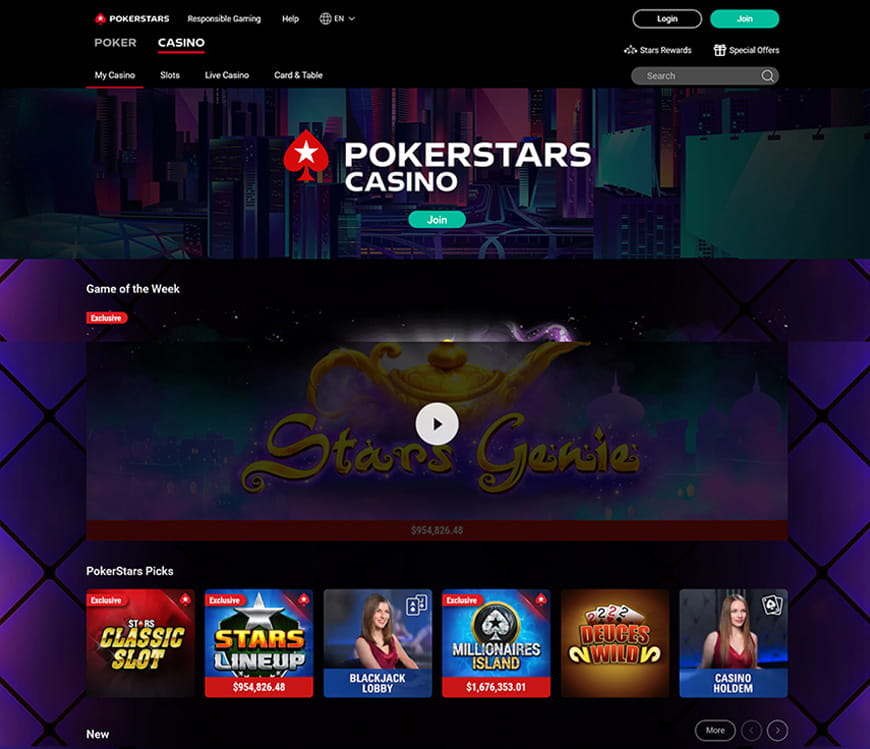

Certain web based casinos with $5 minimum deposit bonuses can get curb your incentive money to particular games, that is common among free spins incentives. Thus, i encourage cautiously learning the fresh T&Cs and you can information and that games you can enjoy using bonus currency. Certain games count a hundred%, although some might only contribute a low fee, and some may not actually number whatsoever. 100 percent free revolves incentives allows you to twist the fresh reels out of a good slot games without having to bet all of your own money. When you are gaming systems tend to were these types of inside invited packages, you can also receive her or him due to some lingering campaigns.

On the nonresident period, determine the brand new NOL utilizing the a lot more than laws and regulations to possess nonresidents. Payments on behalf of a qualified student from a professional state university fees program (including Nyc’s 529 college or university discounts program) are thought licensed tuition expenditures to own purposes of the institution university fees deduction. For many who claim the fresh student as the a centered, such repayments is actually addressed while the repaid by you. Qualified scholar has the fresh taxpayer, the brand new taxpayer’s companion, plus the taxpayer’s dependent (for which an exception for new York County tax aim is welcome).

Are I eligible to score my defense put straight back easily crack my rent?

B. And the remedies up against the renter registered through this chapter, a property manager get apply to the new magistrate for a warrant to have trespass, provided the brand new guest otherwise invitee might have been served in keeping having subsection A good. In the event the such a landlord does not conform to the brand new specifications from so it subsection, the newest applicant to have tenancy get recover statutory damages out of $step 1,one hundred thousand, in addition to attorney fees. The fresh occupant, when the within the palms, provides paid back to the judge the amount of rent discovered from the court to be owed and delinquent, becoming stored from the court pending the new issuance out of a keen purchase less than subsection C.

Both spouses need signal a combined return; we simply cannot procedure unsigned output. From the room given at the end out of webpage cuatro, sign and you can day your own new get back and you will enter into the profession. For more information, see Form They-2105.9, Underpayment away from Projected Taxation because of the Someone and you can Fiduciaries and its own tips.

A Canadian supplier is responsible for fixing busted luggage bins and conveyances belonging to many other companies since the bins otherwise conveyances have the newest Canadian carrier’s fingers. The newest Canadian company tend to bills the master of the box otherwise conveyance on the fix features considering. These types of fix features, as well as https://vogueplay.com/ca/caxino-casino-review/ pieces, is actually zero-rated if they are energized so you can a low-resident supplier. Exports of most assets and you can characteristics of Canada try zero-rated (nonexempt in the rate from 0%). For this reason, so long as particular requirements try fulfilled, you will not pay any GST/HST for the property or services exported to you personally out of Canada. Self-assessment of your GST/HST applies to nonexempt imports of characteristics and you may intangibles anywhere between separate branches of the same individual.

Remain a duplicate of your own income tax details

“Drinking water and you may sewer submetering gadgets” form gadgets accustomed scale real water or sewer use in the any home-based building whenever including products is not had or controlled by the energy or any other merchant from liquid otherwise sewer provider that provides services to your home-based strengthening. “Apparent proof mold” function the current presence of shape regarding the hold unit that is noticeable to the brand new naked-eye by property manager or occupant in the components inside interior of the structure tool readily accessible in the enough time of the move-inside inspection. “Renter details” setting the guidance, and monetary, repair, and other details regarding the a renter otherwise possible tenant, if such data is inside composed otherwise electronic mode otherwise one other typical. “Local rental software” form the brand new authored application otherwise comparable document used by a property manager to decide in the event the a possible renter is capable to getting a good tenant out of a dwelling unit. “Handling broker” form the person approved by the property manager to do something because the landlord on behalf of the brand new landlord pursuant to the created possessions administration contract. Pursue Private Buyer Checking offers an advantage as high as $step 3,100 to own beginning an alternative membership.

- The level of the new payment isn’t lay for legal reasons and you may will likely be negotiated involving the parties.

- Penelope Colon, 26, away from Augusta, Georgia, is arrested and you can faced with seven matters out of fingers from boy intimate abuse matter, with respect to the Leesburg Police Agency for the Friday, Summer 29.

- If getting a lender indication-up added bonus requires transferring over $250,one hundred thousand (the basic amount one’s insured by the Government Put Insurance rates Corp.), you’ll need to use particular methods to ensure that all of the your bank account — along with money more than $250,one hundred thousand — is actually safe.

- You’ll find things you can do to help you limit how much out of your own deposit is retained.

- Like this, taking paid for to play your chosen video game can be helpful even though you’re making a minimal $5 minute deposit.

- Submit as numerous Forms 1099-R since you need to report the Forms 1099-Roentgen your received.

Although this membership suppresses you from overdrawing most of the time, there will probably be times when your account may have a negative harmony. This may happens in the event the total number out of a purchase differs on the count that was in the first place registered, such whenever a guideline try put in a cafe or restaurant charges. For all Lender of America profile, there isn’t any commission to have Statement Spend Services for those who’lso are subscribed to On the web Banking. Under the CMEPA, the administrative centre progress income tax on the sale, change, or import of offers both in residential and you may foreign businesses try today equally pegged during the 15%. Ahead of CMEPA, interest income is at the mercy of a wide range of income tax rates—from completely excused in order to all the way to 20%—depending on the taxpayer, the cause, as well as the term from maturity, as well as others, carrying out high distress. While you are big international buyers can certainly move so you can nearby countries which have straight down if any stock purchase taxes, local merchandising people remain on the shorter glamorous alternatives of possibly affect the burden out of large friction costs otherwise cutting its trading regularity.

And you can half a dozen a good.yards., per flat must be heated to a temperature with a minimum of 55°F. (Several Hold Laws § 79; Multiple House Laws § 173; Nyc Administrator. Password § ). Several dwellings based otherwise changed into for example play with just before January step one, 1968 along with have to have notice-locking gates and you will a two-way intercom program in the event the requested by a majority of all the leases. Landlords get get well the cost of getting it gizmos of renters (Numerous Dwelling Legislation § 50-a). In the performing any works one inhibits direct-dependent color within the relevant renting and you will well-known parts, a landlord need to hire specialists that have completed a course in the lead-secure works strategies.

You ought to fill in the new done borrowing from the bank forms and Form They-203-ATT along with your get back. For many who put Function They-230, Area dos, you should finish the Nonresident and you may part-12 months citizen money percentage agenda from Mode They-230-I, Tips to have Function They-230, to estimate the cash percentage to go into on line forty-five. When you’re and saying the newest impairment income exception (Setting They-225, S-124), the complete of your your retirement and you may annuity income exemption and impairment income exclusion usually do not exceed $20,000.

At the same time, specific teams and you will organizations, such as particular provincial and you can territorial governments, don’t usually spend the money for GST/HST on their orders. For more information, find Publication RC4022, General Suggestions to have GST/HST Registrants. You ought to prefer a credit connection over a financial for individuals who see particular accounts or characteristics that will be good for your targets. A number of the credit unions looked has large-give bank account, if you come across an account that matches what you’re searching to possess, you will not feel just like you might be reducing because there are less things and you can functions.

Leasing Shelter Deposit Calculator Advice

In case your landlord obtains away from a tenant a created request a written statement from charges and you can repayments, he will supply the occupant having a created statement demonstrating all of the debits and you may loans over the tenancy or even the prior 12 months, any kind of are smaller. The fresh property manager should render including authored statement in this 10 business days from acquiring the brand new demand. The fresh authored notice from denial will include the statewide judge help number and you can website address and you will will update the new applicant one to the guy have to assert his straight to issue the newest assertion in this seven days of the newest postmark time. Should your landlord cannot receive a response in the candidate within seven days of your own postmark date, the newest property owner could possibly get just do it. The newest property manager should be able to validate the fresh time and date you to one communication delivered because of the electronic otherwise telephonic form is actually sent to your candidate.

In order to be eligible for this-day cheer, you’ll have probably to arrange head put to your bank and sustain the newest account discover for around a couple months. All of our greatest required online casinos having $5 minimal deposit bonuses will also have reasonable betting episodes, generally as much as 7 days. This provides people a respectable amount of your time to love the brand new added bonus and match the criteria earlier will get gap. For individuals who’lso are to try out during the a genuine currency internet casino, the next step should be to improve minimum put limitation necessary to claim the benefit. When you are here’s however promise that $five-hundred and you may $300 inspections usually arrived at Nyc people in the 2025, logistical and you will governmental delays is actually blocking any firm timelines from are lay.